- Share

China Announces Bold Measures to Boost Economy Amid Celebrations

As China geared up to celebrate its Golden Week and mark the 75th anniversary of the People’s Republic, the government launched a series of initiatives aimed at revitalizing its struggling economy. These measures included support for the crisis-hit property sector, stock market aid, direct cash assistance to the poor, and increased government spending.

Following these announcements, stocks in mainland China and Hong Kong saw record gains, signaling positive sentiment among investors. However, economists caution that these policies may not be enough to fully resolve China’s deeper economic issues.

Measures to Revive the Stock Market

On September 24, the People’s Bank of China (PBOC) announced new strategies focused on reviving the country’s stock market. One of the major moves was the provision of 800 billion yuan (approximately $114 billion) for insurers, brokers, and asset managers to purchase shares. PBOC Governor Pan Gongsheng also mentioned that listed companies would receive support if they wanted to buy back their own shares. The central bank plans to reduce borrowing costs and allow banks to increase lending as well.

Two days later, President Xi Jinping chaired a surprise meeting of top officials to discuss economic challenges. Leaders at this meeting promised to increase government spending to support growth.

The impact of these measures was immediately felt in the market. On the day before Golden Week, the Shanghai Composite Index surged by over 8%, marking its best day since the 2008 global financial crisis. This concluded a five-day rally, with gains of 20%. Similarly, the Hang Seng in Hong Kong climbed by more than 6%.

Deeper Economic Challenges

While the announcements delighted investors, President Xi Jinping faces deeper issues. The People’s Republic’s 75th anniversary marks a significant milestone, as it has now outlasted the Soviet Union’s 74-year existence. Avoiding a similar fate is a major concern for China’s leadership, as highlighted by Alfred Wu, an associate professor at the Lee Kuan Yew School of Public Policy.

The Chinese government is keen to achieve its 5% growth target for 2024. Missing this target could worsen the ongoing downturn in economic growth and further erode confidence. The recent measures also target China’s struggling property market, with a focus on boosting bank lending, cutting mortgage rates, and lowering down payments for second-home buyers.

However, there are concerns that these measures may not suffice. “These policies are welcome, but they might not significantly change the current situation,” noted Harry Murphy Cruise, an economist at Moody’s Analytics. “China’s problem is more about confidence rather than credit availability. Firms and families are reluctant to borrow, regardless of how low the interest rates are.”

Addressing the Property Crisis

The Politburo meeting also emphasized the need for government funds to further stimulate the economy. Leaders prioritized stabilizing the property market, increasing consumer spending, and enhancing employment. However, the size and scope of the promised fiscal stimulus remain uncertain, which has some experts skeptical.

“Should fiscal stimulus fall short of market expectations, it could disappoint investors,” warned Qian Wang, chief economist for the Asia Pacific region at Vanguard. She further added that cyclical stimulus alone cannot solve China’s structural problems, emphasizing the need for broader reforms.

The downturn in the property market has been a significant drag on the Chinese economy. Property investments represent the largest financial commitment for most families, and falling house prices have weakened consumer confidence. “Ensuring the completion of unfinished homes is crucial,” noted Sophie Altermatt, an economist at Julius Baer. She further added that sustainable domestic consumption would require a comprehensive improvement in pension and social security systems, rather than relying solely on one-time financial support.

On the occasion of the 75th anniversary, the state-run People’s Daily published an editorial highlighting a positive outlook for the future. The article emphasized the importance of “high-quality development” and “new productive forces,” both concepts endorsed by President Xi, as key to building a stronger economy.

These ideas reflect the shift from relying on traditional growth drivers, such as property investments, to fostering a more balanced economy centered around high-end industries. However, transitioning to this new growth model presents challenges, as noted by Yuen Yuen Ang, professor of political economy at Johns Hopkins University. “The old and new economies are deeply intertwined. If the traditional economy falters too quickly, it will hinder the rise of the new sectors,” she explained.

China’s leadership has recognized this interdependence and is responding with policies aimed at maintaining stability while fostering new growth avenues. However, the long-term success of these policies will depend on their execution and the ability to overcome both immediate and structural challenges.

You May Also Like

Israeli Hostage Couple Reunited After 738 Days

Raila Odinga Dies at 80: Kenya Mourns Political Giant

Trump Demands Hamas Disarm Amid Brutal Gaza Crackdown

Israeli Strikes on Iran Heighten Tensions

UNIFIL Post Breached: Israeli Tanks Escalate Tensions

Latest Update

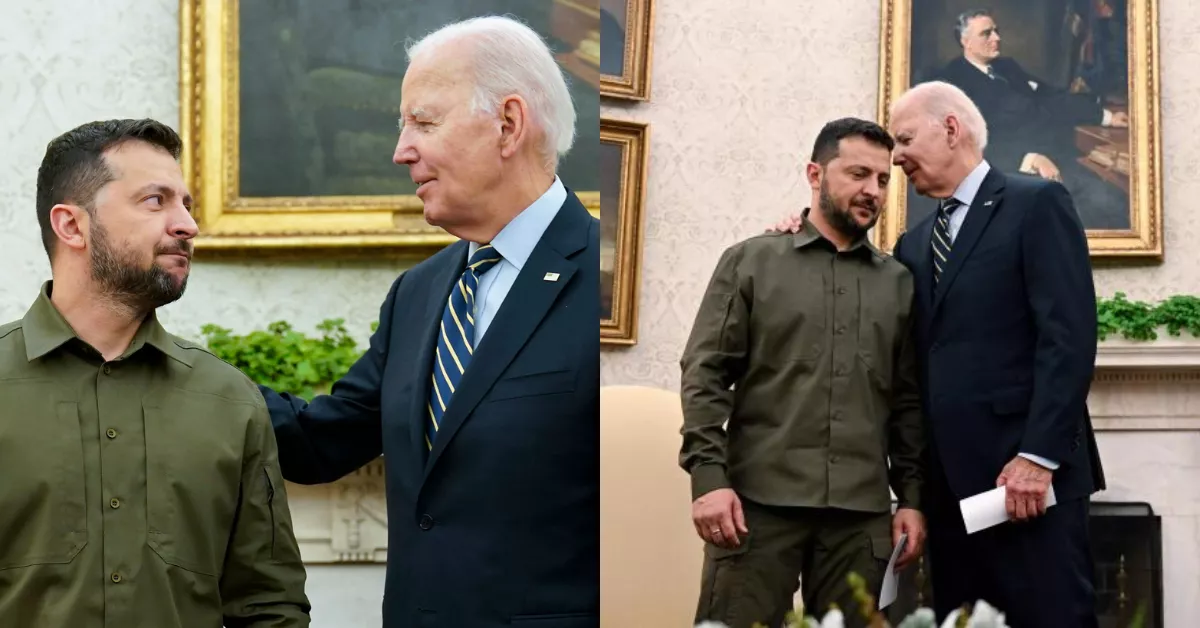

Zelensky Biden Meeting Ignites Republican Outrage Amid Aid Talks

Wuthering Heights Film Casting: Controversy Sparks Debate

Will the US Presidential Election Shape the Future of Crypto?

War with Russia: Zelensky Sees Hope for Peace

Unpacking the ‘Dark Arts’ in Manchester City vs Arsenal Showdown

UNIFIL Post Breached: Israeli Tanks Escalate Tensions

Trump Demands Hamas Disarm Amid Brutal Gaza Crackdown