- Category: Innovation

- Share

The Future of Cryptocurrency Hangs in the Balance

The cryptocurrency industry, according to one of the leading financial regulators in the United States, is fraught with issues like fraud and manipulation. Gary Gensler, the chair of the US Securities and Exchange Commission (SEC), has expressed his concern that global investors have lost significant amounts of money due to cryptocurrency firms skirting the rules his agency enforces. As the industry funnels millions of dollars into political campaigns in hopes of shaping the future regulatory landscape, it is clear that the upcoming US elections could have a decisive impact on crypto’s future.

This high-stakes political season sees not only the presidential face-off between Donald Trump and Kamala Harris, but also the re-election of all 435 House representatives and 33 of 100 Senate seats. With cryptocurrency becoming a central debate, the differences between Trump and the outgoing Biden administration’s approaches to regulation have never been more pronounced.

Donald Trump has recently pivoted to an enthusiastic pro-crypto stance, promising to turn America into the “crypto capital of the planet.” He has even proposed creating a national Bitcoin stockpile, akin to the US gold reserves. This marks a significant reversal from just a few years ago when Trump criticized Bitcoin as a scam and a threat to the US dollar. His newfound enthusiasm for the sector was highlighted by the recent launch of his crypto business, World Liberty Financial, although details remain scarce.

On the other side, the Biden administration, with Harris as vice president, has been leading a regulatory crackdown on crypto firms. This effort gained attention with the high-profile convictions of crypto leaders such as Sam Bankman-Fried of FTX, sentenced to 25 years for fraud, and Changpeng Zhao of Binance, who received four months in prison alongside a $4.3 billion fine for facilitating money laundering through his platform.

The SEC’s Gensler remains focused on enforcing long-standing laws meant to protect investors. He argues that crypto companies must comply with regulations that have been in place since the SEC’s establishment in 1934, after the infamous Wall Street crash of 1929. Despite crypto’s relatively small presence in the broader capital markets, Gensler warns that its unregulated nature could undermine public trust in the financial system.

Though cryptocurrency enthusiasts tout its benefits, such as faster and cheaper transactions, public adoption in the US has waned. A recent Federal Reserve survey revealed that American usage of cryptocurrencies fell from 12% in 2021 to 7% last year, likely due to increasing regulatory pressures and growing concerns about security and fraud.

While Kamala Harris has been relatively quiet on her stance toward cryptocurrencies, her team has recently engaged in conversations with industry executives, hinting at a more balanced approach. Advisors have suggested that she supports policies that foster the growth of emerging technologies, giving hope to crypto advocates for more constructive regulation under her leadership.

This outreach has been well received by industry leaders like Paul Grewal, chief legal officer at Coinbase. He emphasizes the importance of a balanced regulatory environment, not only for the US but for the global market, as the country remains a key player in developing crypto-related technologies. Grewal warns that the US risks falling behind if it fails to create a fair and stable regulatory framework.

As the November elections approach, the crypto industry is working hard to ensure lawmakers sympathetic to its cause are elected. It has already spent an unprecedented $119 million on political donations, far surpassing other industries. This aggressive spending reflects the industry’s determination to influence US Congress and push for lighter oversight, which many critics argue would weaken consumer protections.

Meanwhile, regulatory action against cryptocurrencies continues to expand globally. The European Union introduced new laws in April aimed at preventing the misuse of digital currencies by criminals. However, global regulators are still grappling with setting uniform standards. The G20 is currently working on guidelines for cryptocurrencies, though these remain voluntary and progress has been slow.

Back in the US, a bill aimed at regulating cryptocurrencies has passed in the House but faces resistance in the Senate. Critics argue that the bill would provide insufficient protection for consumers, while supporters in the industry, like Grewal, believe it could offer clarity and fairness for crypto firms. He stresses that the industry isn’t seeking to avoid regulation but wants the same standards applied to crypto as to other financial assets.

As the US presidential election nears, the political battle over cryptocurrency regulation is heating up. With millions of dollars being funneled into campaigns, the outcome could significantly shape the future of this volatile yet promising industry. The crypto community is closely watching, aware that November’s results may determine whether the industry will continue to face aggressive crackdowns or benefit from more favorable laws.

In this evolving landscape, the decisions made by US regulators, lawmakers, and voters alike will have ripple effects not only within the country but across the global crypto market. As the political and financial worlds collide, one thing is clear: the future of cryptocurrency is hanging in the balance.

Starship Rocket Test Success: SpaceX’s Historic Feat

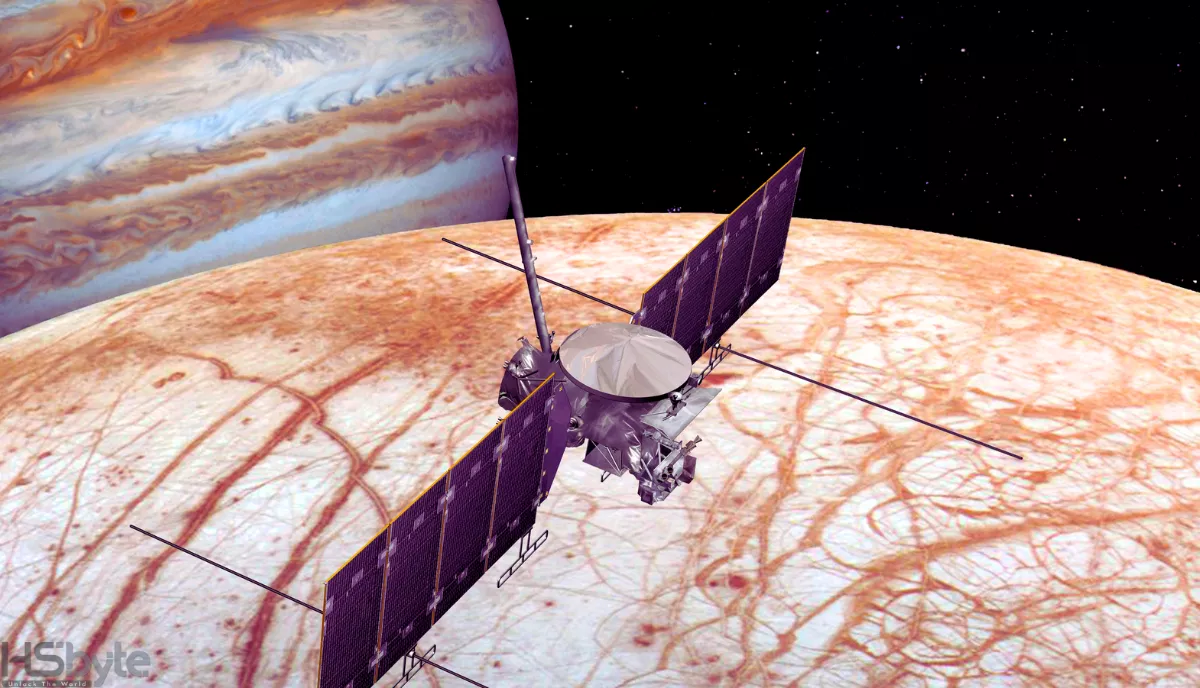

Europa Clipper Mission Launch: NASA’s Bold Hunt for Alien Life

Gate Allocation Technology: Quantum Computing Revolution

Telegram User Data Change: What It Means for You

Will the US Presidential Election Shape the Future of Crypto?

Latest Update

Elon Musk’s Controversy: Shunned from UK Investment Summit

Israel Strikes Hezbollah Relentlessly Amid War Fears

Luxury Yacht Hire In Sydney: Exclusive Waterfront Charters