- Category: Business

- Share

Rising Oil Prices: Middle East Conflict’s Profound Impact

As the conflict in the Middle East escalates, rising oil prices are becoming a critical concern for global economies. The fluctuations in oil prices affect various aspects of daily life, from the cost of groceries to the price of fuel at the pump.

This week, the price of crude oil has surged nearly 10%, reaching around $78 a barrel as tensions in the region intensified. While this increase might seem significant, it’s essential to remember that oil prices are notoriously volatile. For context, following Russia’s invasion of Ukraine, Brent crude oil prices soared to nearly $130 a barrel.

The Ripple Effect of Rising Oil Prices

Countries, including the UK, are just beginning to recover from the sharp spikes in oil prices caused by the COVID-19 pandemic and the ongoing war in Ukraine. So, how concerned should we be about this latest increase?

Crude oil is a fundamental component of petrol and diesel, meaning that higher oil prices will likely lead to increased prices at the fuel pump. Just when fuel prices had recently hit a three-year low, this rise could reverse those gains. Furthermore, if companies transporting goods, such as food, face higher fuel costs, they will likely pass these expenses onto consumers, resulting in a rise in the overall cost of living.

Callum Macpherson, head of commodities at Investec, explains, “Everything we buy in the shop has been transported and made from items that have been transported. The increase in fuel costs tends to filter into everything.”

Bank of England's Concerns

Andrew Bailey, the governor of the Bank of England, has raised concerns about the potential “very serious” impact of the Middle East conflict on the UK economy. He noted that he is monitoring the situation “extremely closely.” This comes as he hinted that interest rates may be set to decrease, given that inflation prospects in the UK are looking more promising after high oil and gas prices had driven inflation up in 2022.

Despite the current increase to around $78 a barrel, experts suggest that there is no immediate cause for alarm. Caroline Bain, chief commodities economist at Capital Economics, indicated that if the worst-case scenario of further escalation does not materialize, oil prices could “ease back quite quickly.”

Impact of Iranian Oil Production

Iran, as the world’s seventh-largest oil exporter, sends half of its oil exports to China. Any disruption in supplies could lead China to seek alternatives, such as turning to Russia. Bain warns, however, that the markets remain “finely balanced,” and if the conflict escalates to the point where Iranian oil production is affected, it could trigger a spike in oil prices.

Although there is ample global capacity to fill any gaps left by a potential loss of Iranian production, there remains the question of Saudi Arabia’s stance as the second-largest oil producer. Whether Saudi Arabia would choose to increase or limit production remains uncertain.

Macpherson also cautions that if Israel were to target Iran’s oil sector, Brent crude prices could rise quickly, impacting fuel prices in the UK and threatening general inflation. However, he notes that there may ultimately be no disruption to supply at all.

Another significant concern arises from the potential blockage of the Strait of Hormuz, a narrow passage critical for oil tanker traffic, accounting for approximately one-third of the world’s total seaborne oil trade. This strait also facilitates about a fifth of global liquefied natural gas (LNG) transportation, a vital commodity since sanctions were imposed on Russia after its invasion of Ukraine.

Asia relies heavily on the flow of oil and gas from the Persian Gulf, and any escalation could have immediate repercussions. A disruption in LNG shipments from Qatar, one of the largest exporters, would result in soaring gas prices, subsequently increasing household gas and electricity bills. Just this winter, UK energy bills have already risen by 10%, although a slight decrease is predicted for January. However, this forecast could change if the Middle East conflict impacts global gas supplies.

Bain suggests the risk of the Strait being blocked due to the conflict remains low. Macpherson agrees, noting that the effect on the UK would be minimal since most of Europe’s gas comes primarily from Norway.

The Uncertain Future of Oil Prices

The potential outcomes of the ongoing conflict remain numerous, and predicting the trajectory of oil prices in the coming weeks and months is challenging. There exists a “wide spectrum” of possible scenarios, but as Macpherson aptly states, “there is really no way of telling where we will be this time next week.”

You May Also Like

Predictable Revenue: How ValueBuilt Is Redefining Predictable Revenue for Modern Businesses

Luxury Yacht Hire In Sydney: Exclusive Waterfront Charters

Rising Oil Prices: Middle East Conflict’s Profound Impact

Electric Vehicle Import Tariffs: EU Imposes Powerful New Measures

Port Strikes Cause Major Shutdown, Sparking Global Trade Fear

Latest Update

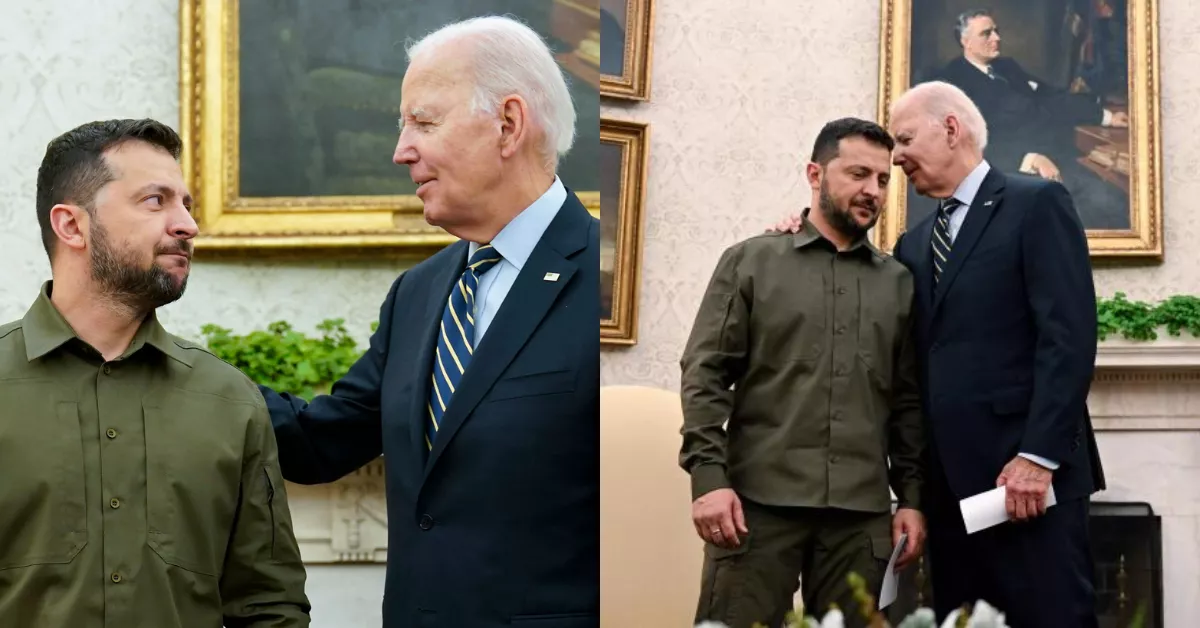

Zelensky Biden Meeting Ignites Republican Outrage Amid Aid Talks

Wuthering Heights Film Casting: Controversy Sparks Debate

Will the US Presidential Election Shape the Future of Crypto?

War with Russia: Zelensky Sees Hope for Peace

Unpacking the ‘Dark Arts’ in Manchester City vs Arsenal Showdown

UNIFIL Post Breached: Israeli Tanks Escalate Tensions

Trump Demands Hamas Disarm Amid Brutal Gaza Crackdown